Lyfebloc Introduction

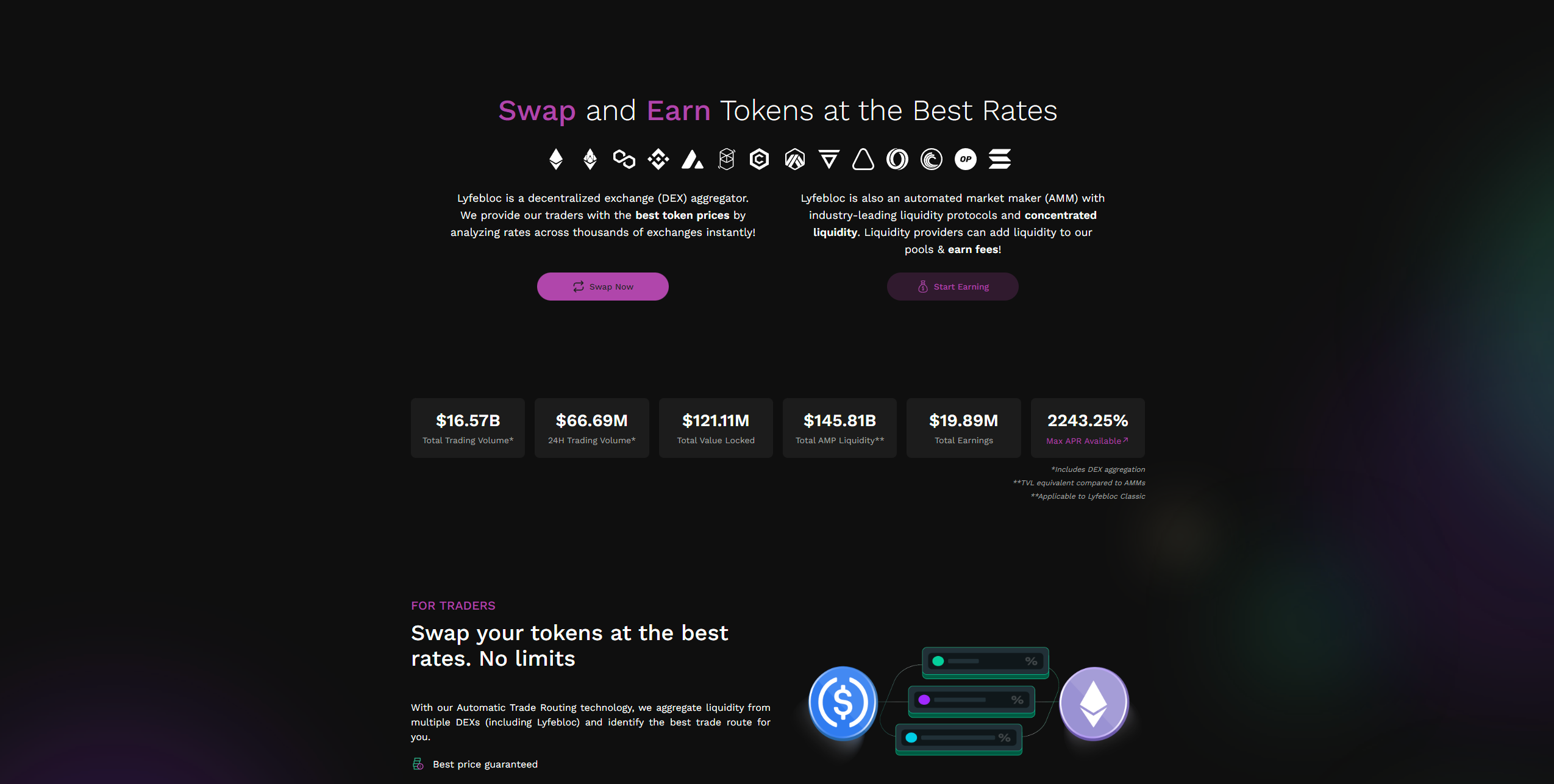

Lyfebloc is The World's first Automatic Market Maker that generates frictionless crypto liquidity with extremely high returns, extremely high flexibility and capital efficiency ...

Supported Platforms

Now we support:

Android(Latest Versions)Ios(Latest Versions)Windows 10-11(Latest Versions)Linux X64macOS(Ventura 13.2.1 and Monterey 12.6.3)Google ChromeOperaEdgeFirefoxSafariSamsungElectronGoogle Chrome

Our Products

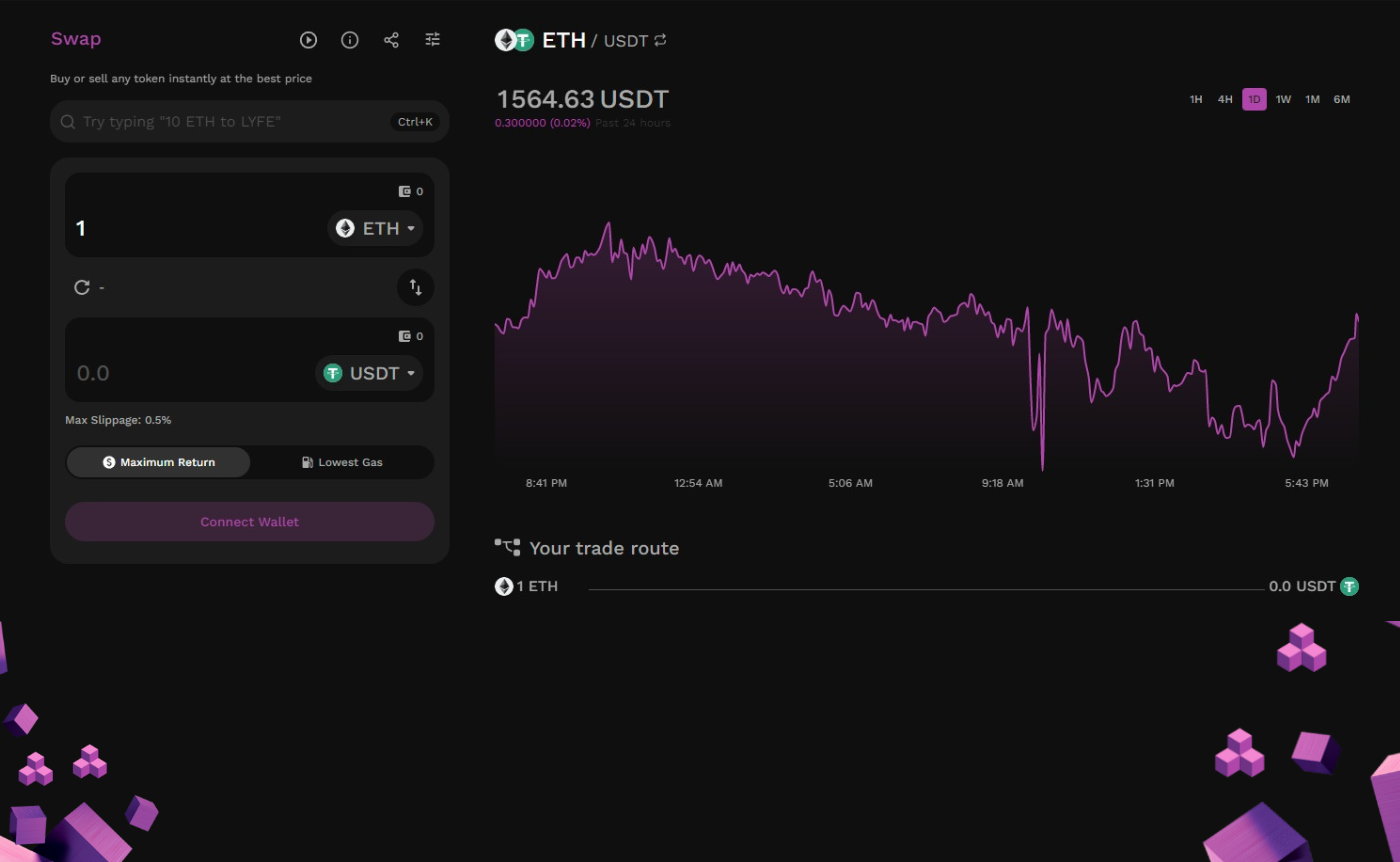

Lyfebloc Automatic Protocol

Automatic Market Maker: A protocol that introduces the World's first Automatic Market Maker implementation.

Concentrated liquidity: the Lyfebloc Automatic allows liquidity provides (LPs) to provide liquidity into a customizable price range. This allows more effective liquidity utilization of the liquidity contributed by liquidity providers.

Reinvestment curve: this curve allows LP fees to be automatically reinvested into the pool at an infinite range, thus achieving the compounding interest for LP position.

- Lyfebloc Multiplier Protocol: The Multiplier Protocol is the worlds first protocol for multiplying liquidity and trading multi-chain cryptocurrency tokens. It eliminates trusted intermediaries and unnecessary forms of rent extraction, allowing for safe, accessible, and efficient exchange activity. The protocol is non-upgradable and designed to be censorship resistant. Liquidity Multiplier Risk Management applies a liquidity multiplier based on Worst Case Loss (WCL) exceeding certain thresholds on the FCM Clearing Member's whole portfolio and individual currencies.

- Lyfebloc Deflationary Protocol: The Deflationary Protocol is a multi-chain cryptocurrency token and on-chain utility NFT Protocol. Deflationary Protocol provides one circulating supply across all blockchains Deflationary Protocol is available on. The Deflationary Protocol Ecosystem of dApps is therefore available to projects and holders on each of those blockchains. The Deflationary Protocol ecosystem and token are fortified by the Auto-Buyback and Stake protocol, which purchases Deflationary Protocol tokens from the market and sends them to the staking rewards pool on the Deflationary Protocol Staking platform. The 4% transaction fee collected for Liquidity Reserve (Auto-Buyback and Stake Protocol) is stored in the Deflationary Protocol and is referred to as the buyback reserve. The buyback reserve acts as a second liquidity pool, exchanging native coins for Deflationary Protocol tokens in the main liquidity pool. The Deflationary Protocol buyback function is automatic based on the amount of blocks minted on the blockchain. The Auto-Buyback and Stake function serves one key purpose: fortifying liquidity pools across all chains. When staking Deflationary Protocol tokens; the amount of tokens staked lock in the wallet for the time period of the stake, and the staker receives Deflationary Protocol (vote escrowed Deflationary Protocol) which empowers them with governance votes. The Deflationary Protocol for each stake is held in a transferrable NFT (nftDeflationary Protocol); which if transferred the stake moves with it. A holder can create many stakes with many different start times; amounts and time periods. The protocol contracts generate automatic liquidity and that can be coded to produce 1%-40% with a 1%-15% Dividend Distributor.

:::